Troubleshooting Guides & Helpful Resources

Patient Exposure Log

Chemistry for Processors

- Chemblend Developer Part A

- Chemblend Developer Part B

- Chemblend Fixer Part 1

- Chemblend Fixer Part 2

- Clinicpak Developer Part A

- Clinicpack Developer Part B

- Clinicpak Fixer Part 1

- Clinicpak Fixer Part 2

- AGFA Developer G153 Part A

- AGFA Developer G153 Part B

- AGFA Fixer G353 Part A

- AGFA Fixer G353 Part B

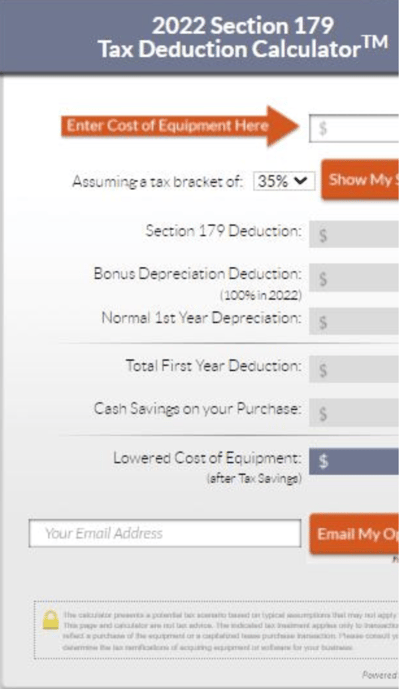

Section 179 Calculator

Upgrade Your Clinic in 2023 and Save on Your Tax Bill

- The 2023 Section 179 tax advantage is for your hospital or clinic.

- In order to qualify for the Section 179 Deduction, the equipment must be purchased, financed or leased and put into service by December 31 of this year.

- Somewhere in here, mention that section 179 has been increased for inflation

Section 179 Details

- Most tangible business equipment qualifies - it must be purchased and put into use between January 1 and December 31 of the tax year you are claiming.

- Section 179 for this year expires at midnight on December 31st.

- You can take full advantage of the deduction when leasing equipment, which is a preferred strategy for many businesses.

- To take the deduction when you file your tax return, simply fill out Part 1 of IRS form 4562 or contact your tax advisor.

Section 179 At A Glance for 2023

2023 Deduction Limit = $1,160,000

2023 Deduction Limit = $1,160,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2023, the equipment must be financed/purchased and put into service between January 1, 2023 and the end of the day on December 31, 2023.

2023 Spending Cap on equipment purchases = $2,890,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive" (because larger businesses that spend more than $3,780,000 million on equipment won't get the deduction.)

Bonus Depreciation: 100% for 2023

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment. The above is an overall, “birds-eye” view of the Section 179 Deduction for 2023. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please read this entire website carefully. We will also make sure to update this page if the limits change. Read more here.

Always contact your tax advisor to verify tax or accounting issues or visit www.irs.gov for specific details.

Technique Charts

Imaging technique is a science. The appropriate technique depends on the power of your generator. You may download the technique chart for your x-ray system from the options below:

we promise a consistent, worry-free experience

At LS X-Ray, we hire the best engineers and work with the best vendors to provide a consistent, worry-free experience for your equipment’s lifetime. Let us handle the stress of designing, sourcing, and servicing x-ray equipment so you can focus on what you do best.